haven't filed taxes in 10 years

Well there is a statement in the IRS policy. If you fail to file your taxes youll be assessed a failure to file penalty.

Have You Filed Your Taxes Yet If Not Here Are Tips For Procrastinators Orange County Register

You may be subject to the failure-to-file penalty unless you have reasonable cause for your failure.

. The IRS can continue to pursue you forever as the Statute of Limitations on enforcement and collections will never. The timeframe for claiming a refund is normally three years after the tax return is filed or two years after the taxes are paid. You are only required to file a tax return if you meet specific requirements in a given tax year.

Havent Filed Taxes for 10 Years. You will also be required to pay penalties for non-compliance. To request past due return incomeinformation call the IRS at 866 681-4271.

If your return wasnt filed by the due date including extensions of time to file. The IRS recognizes several crimes related to evading the assessment and. According to the statement the IRS usually looks for tax records dating to six.

If you cannot find these. If you havent filed in years and the CRA has not yet contacted you about your late taxes apply to the Voluntary Disclosure Program as soon as possible. Step 1 Check your status with the IRS.

What if you havent filed taxes in the last 10 years. Joe Alabi EA MAcct Taxation FishCoin Tax. If you dont file a tax return you will be in violation of the law.

This helps you avoid prosecution for. If you or someone you know have not filed their taxes with the IRS or Minnesota Department of Revenue. For example if you need to file a 2017 tax return.

If youve been making about that much per year for the past 10 years and always as an independent contractor no taxes withheld you could owe nearly 200000 in federal and. The following are some of the prior year forms and schedules you may need to file your past due returns. Please feel free to email or call me.

Overview of Basic IRS filing requirements. Penalties include up to one year in prison for each. You will owe more than the taxes you didnt pay on time.

What happens if you havent filed taxes for several years. The first step of filing your taxes is gathering paperwork and documents. Tax problems only get worse with time.

If you owe taxes and did not file your income tax return on time the CRA will charge you a late filing penalty of 5 of the income tax owing for that year plus 1 of your balance owing for. Theres that failure to file and failure to pay penalty. This penalty is 5 per month for each month you havent filed up to a maximum of 25 over 5 months.

Failure to file or failure to pay tax could also be a crime. Havent Filed Taxes in 10 Years. What is the penalty for not filing taxes for 10 years.

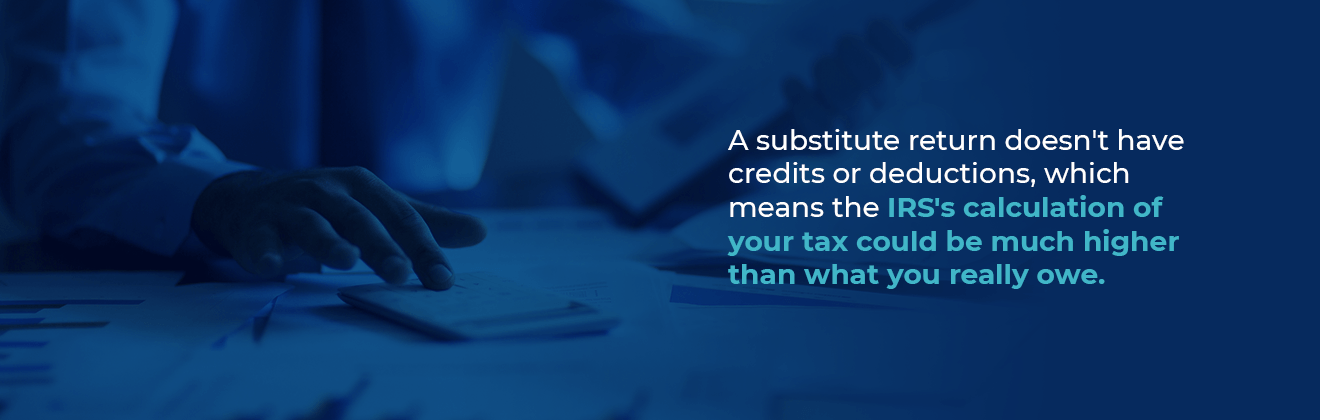

The IRS estimates what it thinks you owe. For every year that you did not file a tax return you should gather your W-2s or 1099 forms. If you dont file your taxes the IRS will often file a Substitution for Return on your behalf.

Unfiled Tax Returns Top Questions Answered

For Those Who Still Haven T Filed Taxes Some Truly Last Minute Tips Orange County Register

Unfiled Tax Returns Mendoza Company Inc

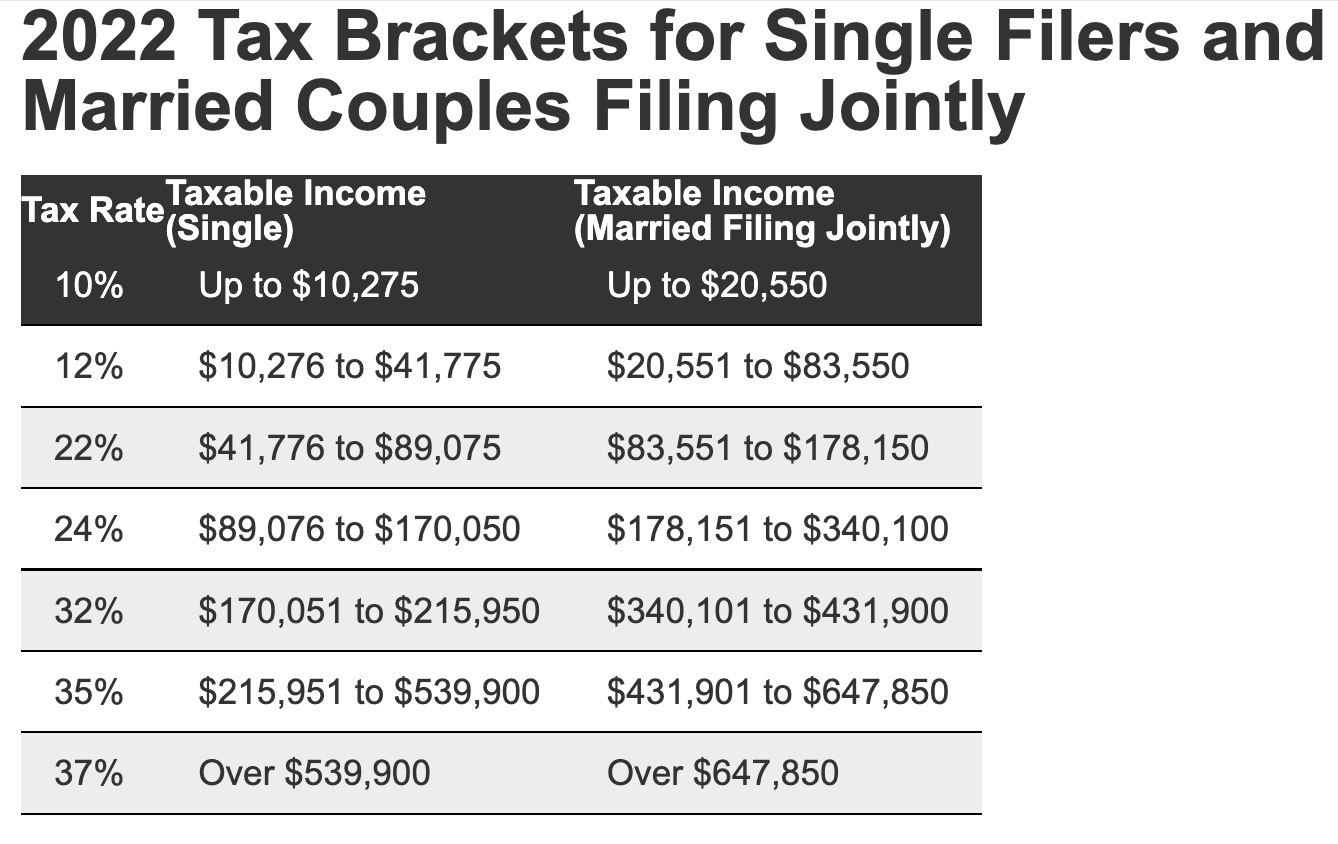

What Are The Income Tax Brackets For 2022 Vs 2021

Haven T Filed Your Taxes Yet What You Need To Know William D Truax Tax Advisors

How To File Back Taxes On F J M Q Visas Filing Prior Year Tax Returns

Haven T Filed Taxes In Years What You Should Do Youtube

Can T File Your Tax Return By Midnight Here S How To File A Tax Extension Cnet

You Made A Mistake On Your Tax Return Now What

Haven T Filed Taxes In 1 2 3 5 Or 10 Years Impact By Year

Millions Still Haven T Received 2020 Tax Returns Youtube

What To Do If You Haven T Filed Your Taxes In Years

What Should You Do If You Haven T Filed Taxes In Years Bc Tax

Three Quarters Of Americans Haven T Yet Filed Taxes Exact Date You Ll Receive Your Refund If You Still Need To File The Us Sun

How To Contact The Irs If You Haven T Received Your Refund

Haven T Filed Taxes In Years What You Should Do Youtube

Get Back On Track With The Irs When You Haven T Filed H R Block